September Market Report

BackIt’s early fall. That typically means dairy markets begin tightening up as milk production wanes post-flush; normally, draw-downs start on inventories built in spring and summer.

But this time around, something is off. The only remarkable thing about dairy markets right now is how unremarkable they are. What’s the deal?

Stable trading ranges

As September drew to a close, markets remained unusually long. Inventories and production were both stable when both normally tend to soften. It was evident in the way market prices were moving —or, in this case, not moving— on the Chicago Mercantile Exchange.

Cheddar blocks traded between $1.50 and $1.75 for weeks. Barrels were trading between $1.40 and $1.75. Even now, we’re not seeing anything to indicate prices will break out of those channels on either the high or low end.

The same is true for dry products. Whey powder prices have firmed up lately into the $0.35 range, where we expect them to remain for a while. Whey protein markets lately are softer, trading in a $0.35 – $0.40 range. We think they will continue trading in that range.

Nonfat dry milk had also been trading at low but stable prices until it broke downward on news that the European Union’s intervention commission planned to sell off more than 100,000 tons of its aging powder inventory.

Only butter has been bullish

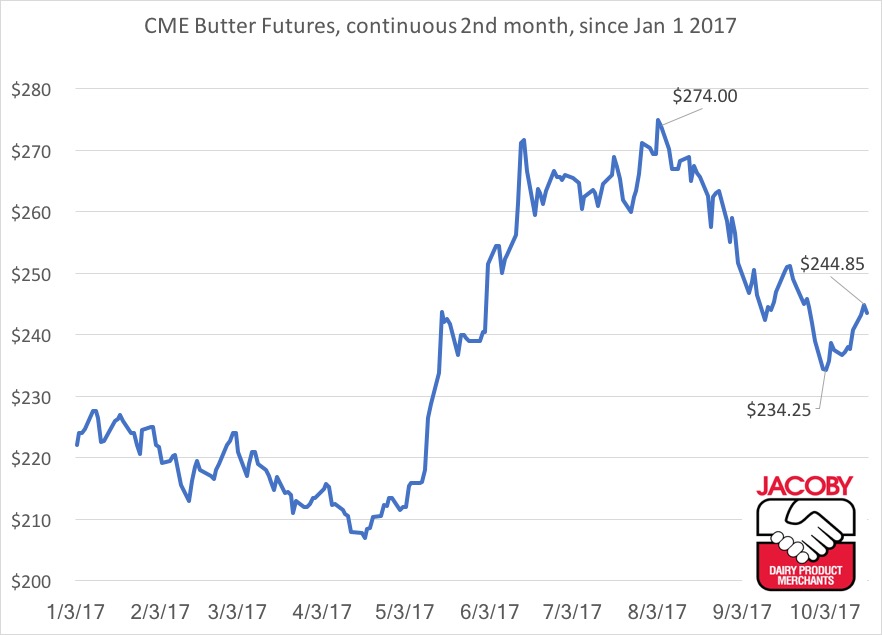

We’ve stated before that butter has been probably the most exciting of the dairy complex markets in the last few months. That remains the case, but nearby CME futures have come off of highs a few months ago to find new levels of trading range support from $2.32 to $2.52.

The feeling of the price action this year has been that of an anticipatory bull market, in which this year, we have seen prices rise sharply counter to the fact that domestic butter stocks are ample but instead rise sharply due to the threat potential for U.S. 82% butter exports to rise sharply in Q3 / Q4 2017. Domestic inventories remain high for the moment, so we don’t expect prices to break upward above midsummer highs. Nor do we expect a sharp downturn, as peak season demand has just begun.

While butter markets have come down from highs established a few months ago, we’re watching a few topics closely:

- The world market for butterfat remains tight, largely due to low inventories in Europe. Even after holiday orders are filled, we expect prices will find a support floor of $2.00 or higher.

- We’re not seeing any new surprise information from the butter shortage overseas that would provoke a new surge in the U.S., but the skim milk powder / nonfat dairy powder market relationship to butter will be important to watch given the recent discussion around releasing large quantities of skim milk powder from EU intervention. Butter and non-fat (skim) milk tend to trade in relationship to one another, since they are both balancing channels for fluid milk.

- On the flip side of that coin, American producers don’t appear eager to convert to 82% butterfat in order to export. Churns fear that to occupy their idle capacity to pursue short term opportunity could hurt their effectiveness at serving their longer-term clientele during key production season. The conversion costs, freight bills and cost-prohibitive EU duties do not seem to provide enough incentive for many U.S. churns to participate in this business.

- We’re also watching the speed at which domestic butter stocks are drawn down to meet the holiday orders this season. An aggressive draw down, or a lack thereof, will help determine the direction of prices in the coming weeks and months. We do expect to see some additional cream and butter exports to rise slightly, but not on a large scale that would fuel a rally.

So what’s with the stable markets?

One possible explanation for why most dairy markets seem stuck in their respective ruts is the weather.

Outside of some localized heat waves, it has not been a harsh summer in the U.S. Supplies remain generally longer than normal throughout the country as midsummer stress on cows has been blunted by pleasant temperatures. Feed is abundant, too. Prices are low after bumper crops last year; this year’s harvest is shaping up to be almost as good.

That in turn has kept handlers and processors at capacity, and helps explain stable prices. Markets seem to be balanced.

Of some concern is sluggish growth in demand, especially for cheese. We usually see that tick upward at two or three percent each year. But this year, it appears to be flat. It could be a sign that the economic recovery in progress here hasn’t been as robust —at least for consumers— as everyone thought.

Listen to The Milk Check — the most comprehensive podcast in the dairy industry.

Listen to the Milk Check

Read our weekly market reports for the sharpest analysis on industry topics and trends.