July market report

BackButter is the talk of the trade

By far the most noteworthy dairy market at the moment is butter.

While butter typically peaks in late summer and early autumn, a surge in domestic spot prices that began in mid-April continues, sending prices from $2.0625 to over $2.7000 per pound by mid-June. And there’s no sign —at least for now— that indicates prices may fall back in the coming weeks.

So how high will butter go?

The key to answering that lies in recognizing two things: First, we have butter rallies every year. This is not uncharted territory.

Second, the circumstances driving the current rally appear to differ greatly from those that drove previous ones, so we also are in uncharted territory.

Previous butter rallies

Plot spot butter prices over time and you’ll notice that these rallies are par for the course. You’ll also notice that once butter prices peak for a few days, they usually fall back rapidly.

In 2014, prices marched steadily upward in the first seven months before leaping from $2.4000 per pound in August to $3.0000 by mid-September. It peaked at $3.0600 between Sept. 19 and Sept. 25 before falling back sharply, settling at $1.5500 by the end of the year.

In 2015, prices again increased steadily but then skyrocketed in September. By Sept. 23, the price reached $3.0250. Two days later, the record spot price was set at $3.1350. A secondary rally in October and November saw prices approaching $2.90 before retreating to just over $2.00 by the end of the year.

Last year was a roller coaster year for butter that saw prices top out at a relatively tame $2.3675 in mid-June. A steady decline followed, and prices bottomed out by the end of October at $1.7500. Another rally occurred in November and December, and prices settled out around $2.2500 as 2017 began.

Why 2017 is different

There’s added intrigue this year among those closely eyeing spot prices.

The first clue that this is something new is the timing. Seasonal surges typically begin around the beginning of autumn, corresponding with seasonal demand—the classic October rally. But the current rally began in April, when U.S. milk production nears its peak and when demand for butter is relatively soft.

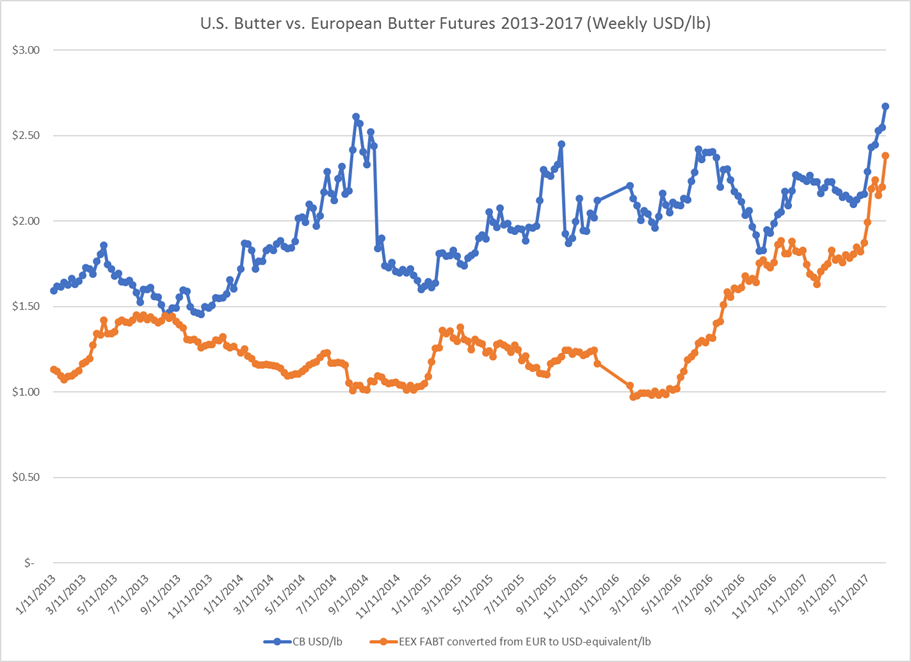

The second clue may be responsible for the first: A comparison of domestic and European spot prices over time shows an interesting dynamic between domestic and international markets.

In each of the last three years, tight domestic inventories sent prices upward. This year, producers expect to have enough inventory to satisfy domestic needs. That’s not the case overseas, especially in Europe, where producers already fear they won’t have enough butter to keep pace with holiday demand. The recent rally in international prices supports this.

So what’s going to happen?

While international inventory challenges have brought overseas prices in line with prices in the U.S., a complicating factor is that European churns source 82 percent fat cream while the domestic standard is 80 percent fat. Domestic producers are surely aware of the shortage overseas, but they aren’t racing to meet that demand—yet.

For one thing, it’s ice cream season. Demand for cream for ice cream production in the U.S. far outstrips the troubles overseas. There remains no domestic incentive to divert cream for European butter instead of for American ice cream in the middle of summer.

There’s still enough domestic butter inventory to get through the holidays here. But a prolonged shortage in the European market could raise international prices high enough to incentivize U.S. butter manufacturers to make 82 percent butter for export instead of 80 percent butter for domestic use. That could not only spike domestic butter prices but also send ripples into other U.S. dairy markets late this year.

So how high will butter prices go? That’s hard to predict because the conditions driving this rally are unique. How long will the rally last? Domestic price history tells us that classic rallies peak for just a few days before the bottom falls out. While that’s entirely possible, it’s also possible to see several weeks of peak prices because the forces driving this rally appear to be quite strong.

Listen to The Milk Check — the most comprehensive podcast in the dairy industry.

Listen to the Milk Check

Read our weekly market reports for the sharpest analysis on industry topics and trends.