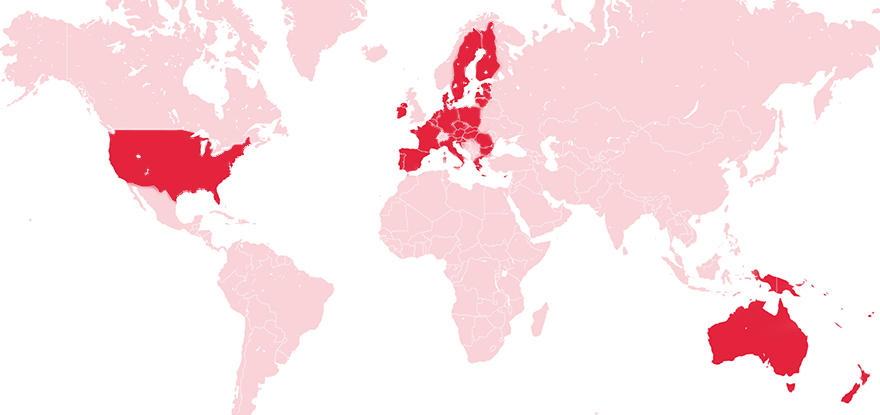

Global dairy production fuels perhaps the most dynamic and volatile agriculture commodity market. And while dairy products are consumed all over the world, most of the milk at the foundation of those products comes from three regions around the world.

The U.S., Europe and Oceania are the world’s major dairy producers, but each region has its own unique characteristics and history that can help predict how global dairy production evolves in the future.

By adopting product planning and balancing strategies based on a deeper understanding of these important regions, buyers and sellers can secure a profitable future.

The U.S. is the growth leader in global dairy production

It’s not because the U.S. produces the most raw milk in the world. Europe takes that trophy (nearly 344 billion pounds collected among the 28 E.U. member nations in 2017 compared to 215 billion pounds collected in the U.S.).

Rather, the U.S. is the most important player on the world stage because more of the global dairy supply is sourced here. Also, dairy market trading tools in the U.S. are more advanced than elsewhere in the world. The U.S. will retain its hold as the center of global dairy because there’s room for production in the U.S. to keep growing and for its market tools to continue to mature.

U.S. dairies are bigger than farms elsewhere in the world. The most profitable American dairy herds number in the thousands. Herd populations can get so high here because there’s plenty of land available to support them, especially in the West and Southwest.

Larger herds allow American farmers to cash in on economies of scale. Production costs in the U.S. are lower than in Europe because those costs can be spread over more revenue sources. Economies of scale are evident at the processing level, too. Plants in the U.S. are big and getting bigger.

Finally, while milk production ebbs and flows according to the seasons, variance in the U.S. is less pronounced than elsewhere in the world. That’s because dairy cows here are fed mostly by grain instead of by grazing. Milk production fluctuates in the U.S., but the more consistent diet fed to American cows means their production is more predictable.

Europe: The largest milkshed in the world

More milk is collected in Europe than anywhere else in the world. Everyone else in the world watches Europe for signals about what will happen with dairy markets across the globe.

Europe might also be the most volatile dairy market on the planet, and it’s not because its large geographic area features widely varying climates and weather patterns (although that certainly contributes).

Instead, government policy is largely responsible for creating dairy markets that are more volatile in the European Union now than at any other time in its modern history. For three decades prior to 2016, dairy production there was subject to quotas that kept production below its actual potential. The policy kept prices paid to dairy farmers higher than if the market was totally free.

The removal of quotas in 2015 led to producers in some countries significantly expanding their operations while others drew them down. At the same time, producers across the E.U. were suddenly free to produce however much milk they wanted after a generation of strict controls. Now into the third full year without quotas, the freer market has proved hard to navigate. Dairy supplies and prices in the E.U. remain more volatile than in the past.

Aside from Europe’s grappling with life after quotas, its status as a global dairy production powerhouse is challenged by a unique constraint: Space.

It’s the opposite of the trend in the U.S., where large tracts of land remain available for larger and more profitable dairy farms. Europe is characterized by traditionally smaller farms with smaller herds. And while some producers have found ways to expand their operations, it’s harder to do in Europe. A lack of available contiguous acreage precludes massive farms like those found across the U.S. Economies of scale are more elusive.

Accordingly, it’s more expensive to produce milk in the E.U. And while it remains the largest milkshed in the world, production growth there is the lowest of the three key milk-producing regions of the world.

Oceania: A dynamic player in global dairy production

New Zealand is the most important dairy-producing nation in Oceania. And while the region produces far less milk per year than either Europe or the U.S., it plays an outsized role on the world stage for two reasons:

- Located in the Southern Hemisphere, it reaches peak dairy production during production lulls in the U.S. and Europe. This counterbalance ensures that the global dairy supply remains somewhat balanced.

- It’s also closer to east and southeast Asia than both the U.S. and Europe, making it a preferred source for dairy products in markets experiencing the greatest demand growth.

With few exceptions, dairy cows in Oceania are grazed on pastures instead of in American-style feed lots. On the one hand, it’s an advantage to farmers who need not constantly purchase feed. But it’s also a liability. Relying on pastures to feed dairy cows means relying on pasture conditions.

Production at given intervals throughout the year varies wildly in Oceania for this reason. For example, milk production per cow in June (in the dead of the Southern Hemisphere winter) typically is about 10% of what it is during the spring flush.

Add to that the fact that farmers can’t control how much it rains. Current events tell the story: Drought was declared on New Zealand’s South Island in February after sustained dry weather limited pasture growth. That resulted in lower-than-expected milk collection. It also put into jeopardy farmers’ ability to feed their herds through winter since they began drawing down on stored feed at a time when they would ordinarily bolster their supply.

It’s also harder to expand herds in New Zealand because land costs are rising.

Navigating global dairy markets

Variability is the only constant in world dairy markets. As the economy surrounding the global food supply matures, buyers and sellers who keep tabs on the dynamics within and among milk-producing regions are in better position to manage risk and maintain a competitive advantage.

Partnership with a commodity trader like T.C. Jacoby & Co. can help secure that advantage. Our traders keep a close eye on key dairy production metrics around the world and apply their industry knowledge to solve inventory problems for buyers and sellers almost anywhere in the supply chain.

If you want to deepen your understanding of global dairy markets, explore the content in our learning center. You can also stay up to date with the latest trends and observations in the industry by subscribing to our articles, market reports and podcast episodes. Click here to get set up.